The Only Guide for Property By Helander Llc

The Only Guide for Property By Helander Llc

Blog Article

The Buzz on Property By Helander Llc

Table of ContentsFascination About Property By Helander LlcThe smart Trick of Property By Helander Llc That Nobody is Talking AboutAll about Property By Helander Llc5 Easy Facts About Property By Helander Llc ShownSome Known Details About Property By Helander Llc The Definitive Guide to Property By Helander Llc

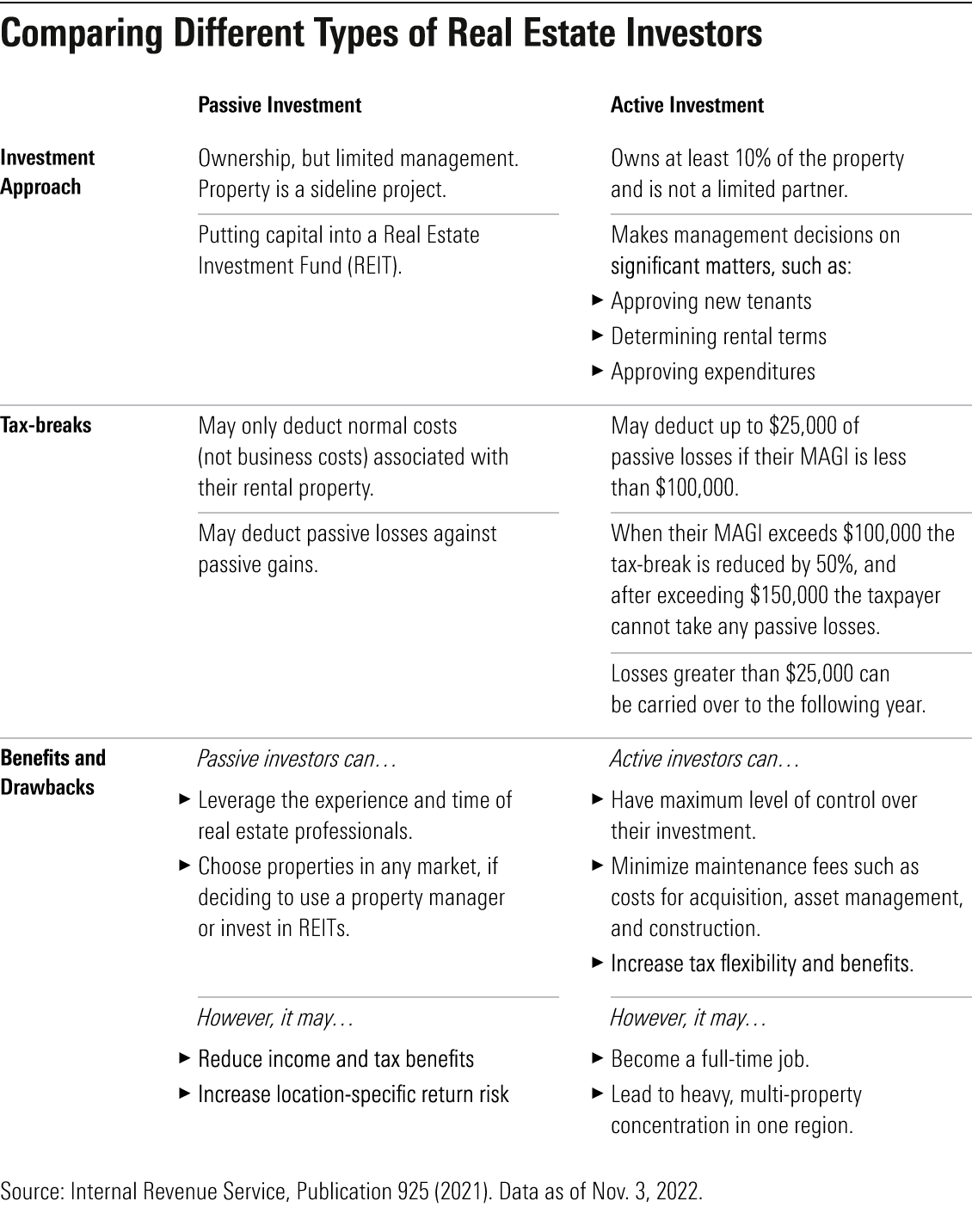

The advantages of buying property are various. With well-chosen properties, investors can delight in foreseeable capital, outstanding returns, tax obligation benefits, and diversificationand it's feasible to take advantage of realty to build riches. Considering buying real estate? Below's what you require to find out about genuine estate benefits and why realty is thought about a great financial investment.The advantages of buying realty consist of easy income, steady capital, tax benefits, diversity, and leverage. Realty investment company (REITs) supply a means to invest in genuine estate without having to have, run, or finance properties - https://www.avitop.com/cs/members/pbhelanderllc.aspx. Capital is the earnings from a real estate investment after home loan payments and general expenses have actually been made.

In many instances, capital just reinforces in time as you pay for your mortgageand accumulate your equity. Investor can make the most of countless tax obligation breaks and deductions that can save money at tax time. As a whole, you can subtract the practical expenses of owning, operating, and managing a building.

Property By Helander Llc Things To Know Before You Buy

Realty worths have a tendency to enhance gradually, and with a good financial investment, you can turn an earnings when it's time to sell. Rental fees also tend to climb gradually, which can result in higher capital. This graph from the Reserve bank of St. Louis reveals mean home costs in the united state

The areas shaded in grey suggest united state recessions. Typical Sales Price of Residences Cost the USA. As you pay for a home home loan, you develop equityan property that becomes part of your total assets. And as you develop equity, you have the take advantage of to buy even more residential or commercial properties and enhance capital and riches much more.

Because real estate is a concrete property and one that can serve as security, financing is readily available. Actual estate returns vary, depending on factors such as location, property class, and management.

Property By Helander Llc for Beginners

This, in turn, translates right into greater capital worths. Actual estate has a tendency to keep the acquiring power of capital by passing some of the inflationary pressure on to renters and by incorporating some of the inflationary pressure in the kind of funding gratitude - sandpoint id realtors.

Indirect genuine estate spending includes no direct ownership of a building or residential properties. There are several ways that having real estate can safeguard against inflation.

Finally, buildings financed with a fixed-rate funding will certainly see the loved one quantity of the regular monthly mortgage payments drop over time-- for example $1,000 a month as a fixed payment will certainly come to be less difficult as rising cost of living erodes the purchasing power of that $1,000. Typically, a primary home is not thought about to be a property investment given that it is made use of as one's home

Our Property By Helander Llc Ideas

Despite having the assistance of a broker, it can take a few weeks of work simply to discover the appropriate counterparty. Still, real estate is a distinctive property course that's simple to comprehend and can improve the risk-and-return profile of a capitalist's profile. On its very own, realty offers capital, tax obligation breaks, equity building, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing genuine estate can be an unbelievably fulfilling and profitable endeavor, yet if you resemble a great deal of brand-new capitalists, you may be questioning WHY you should be buying property and what advantages it brings over various other financial investment possibilities. In enhancement to all the remarkable advantages that come with spending in realty, there are some disadvantages you need to consider as well.

More About Property By Helander Llc

If you're looking for a method to acquire right into the realty market without needing to spend thousands of hundreds of bucks, check out our residential properties. At BuyProperly, we make use of a fractional ownership model that allows investors to start with as low as $2500. An additional significant advantage of realty investing is the ability to make a high return from purchasing, remodeling, and reselling (a.k.a.

Little Known Questions About Property By Helander Llc.

For instance, if you are charging $2,000 rent each month and you incurred $1,500 in tax-deductible costs per month, you will only be paying tax on that $500 revenue monthly. That's a huge distinction from paying tax obligations on $2,000 each month. The profit that you make on your rental for the year is thought about rental revenue and will be exhausted accordingly

Report this page